Introduction to Customs Code Classification

The complexity of taric-code classification

A common question in customs clearance is:" what's the functioning of this good, from which material is it made of?" Quite understandable, considering that a good such as a cat fishing rod is not the most popular one and that it can be made out of several materials. These questions are often asked due to customs code classification or also known as product classification into the customs tariff nomenclature.

Customs code classification is a crucial task in customs clearance since, for importing commodities, the product's tariff rate is determined. However, it is quite often not only a crucial task but can also be challenging and risky due to the tariff rates. But why is this so? A good example of this is a Snuggie, a fleece blanked with sleeves, that became a cultural phenomenon in 2009, even gaining Oprah Winfrey's "seal of approval" and a segment on Saturday Night Live. Looking into the customs clearance industry, the garment became ensnarled in an international trade dispute over whether it should be classified as a "blanket" or a "piece of clothing". If, as determined by the European Taxation and Customs Union, the Chinese-made Snuggie qualified as a "sleeved polyester fleece wrap", it would be subject to a 12 percent import duty. But if, as its manufacturer claimed, the Snuggie actually met the definition of a blanket, the rate would be a significantly lower 7.5 percentage. The dispute escalated to the court of international trade where the court ruled the Snuggie was, in fact, a blanket. Besides the strong public popularity the case gathered, it perfectly demonstrates:

- the significance of proper customs code classification,

- the slight variations that makes it hard to distinguish one code from another but having broad - - tariff implications,

- that manufacturers can succsessfully challenge disputes over product classifications.

However, to be sure, assigning the correct customs tariff number can be complicated and a time-consuming task. Before the complexity of customs code classification is highlighted, the TARIC-System, which is the integrated Tariff of the European Union, will be briefly described.

TARIC - The Integrated Tariff of the European Union

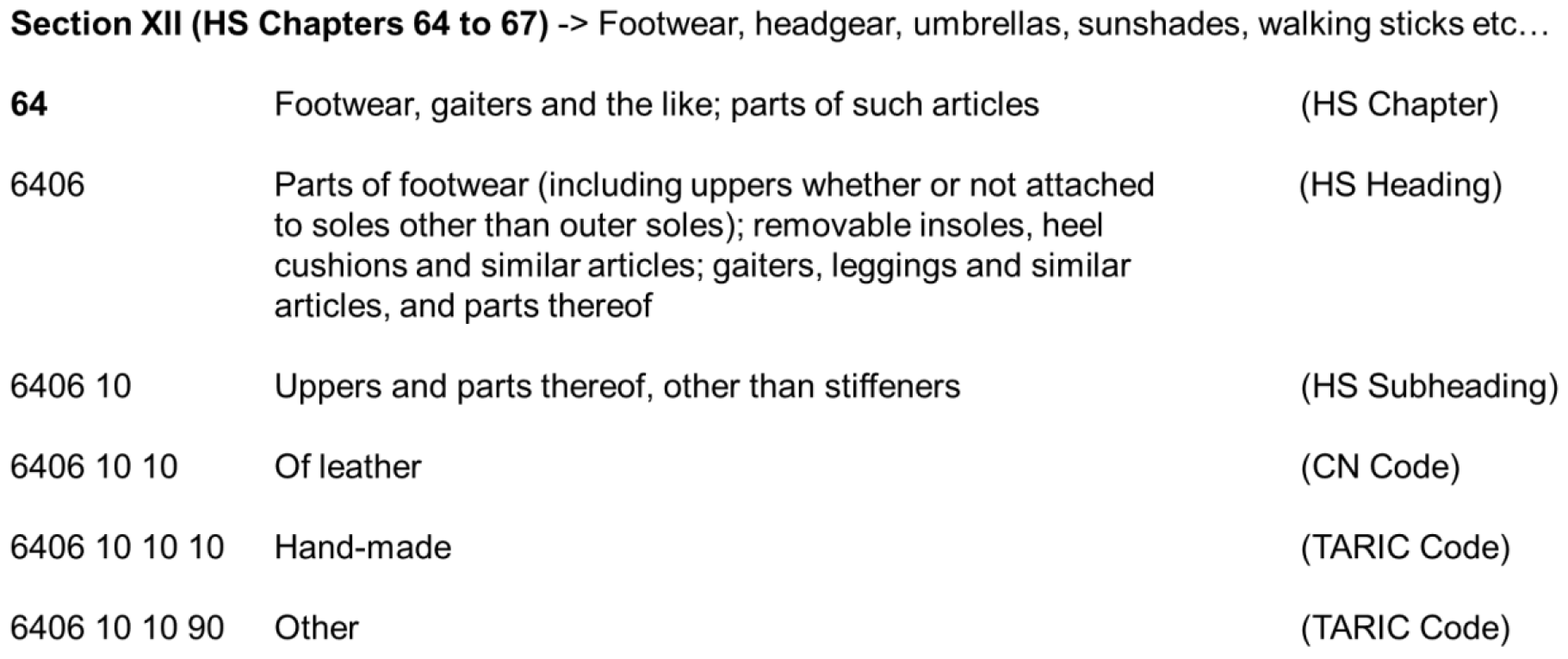

The TARIC is a multilingual database integrating all measures relating to EU customs tariff, commercial and agricultural legislation that comprises four components: the Harmonized System (HS), the Combined Nomenclature (CN), the TARIC system, and, where appropriate, national code extensions. The structure of these components is as follows:

Harmonized System → developed by the World Customs Organization

- 5.000 commodity codes,

- 21 sections including general notes and explanations on the classification of goods,

- 99 chapters (2 figures) + special notes and explanations on the classification of goods,

- Position harmonized system (4 numbers) including more specific classification rules,

- Subheading Harmonized System (6 figures),

- Purpose → The HS is an international nomenclature for the classification of products. It enables - participating countries to classify commercial goods for customs purposes on an everyday basis.

Combined Nomenclature → EU-wide application of an eight-digit numerical code

- Contains the HS and another subheading (seventh and eighth digit),

- Purpose → Serves to document trade statistics within the EU and in respect of goods exported from the EU to the rest of the world and the items listed under TARIC.

TARIC - Tariff Intégré Communautaire / Tariff intégré des Communautés européennes

- Includes the eight figures of the CN plus a ninth and 10th figure for a uniform EU-wide marking for customs purposes and trade statistics in import.

- Depending on the EU member state, there may be between 1 additional number (Germany) and three additional numbers (France). -These regulate VAT matters and possible national bans and restrictions.

An example of the structure of the goods nomenclature is described below up to the 10th digit:

Besides, customs tariff numbers, i.e., the CN and TARIC system, have other essential functions:

- documentation of tariff, agricultural and trade policy measures,

- listing of prohibitions and restrictions on import and export,

- special units of measurement of the goods to be taken into account,

- listing of EU Codes, country and territory codes and additional codes.

The selection of a customs tariff number can trigger the customs measures just mentioned. A customs specialist has to check/analyze documents/goods, whether, e.g., possible prohibitions & restrictions, preferential treatment, or other effective measures. The results of these checks/analyses are commu-nicated to the customs office by customs codes for each line item in a customs declaration. Customs codes include customs tariff numbers and their additional codes, preference type codes, document type codes, message type codes, procedure and procedure additional codes, and many more. Now that the structure of the TARIC is known, the current simplified process of assigning customs codes and a comprehensive description of the thumb rule for customs code classification is explained in the subsequent sections.

Procedure & Rule-Base in Product Classification

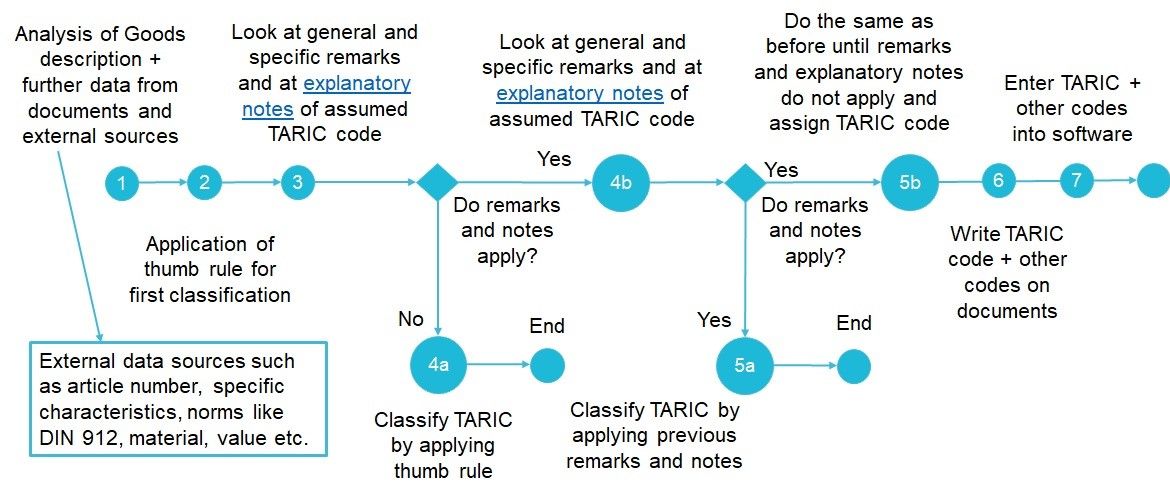

A well understandable way to describe the complexity of product classification in customs, is to dig deeper into a simplified process as well as the rule applied to execute this process (see figure 1 and 2). For a better explanation of the processes, we assume an import with six invoices and 200 items of goods on them, which list simple goods, blood samples, screws, chemicals, gaskets, and a cat fishing rod. To assign customs codes, it is first necessary to classify the listed goods in the TARIC system. Now for simple goods, where the complete description of goods is available, the usual classification process and extensive thumb rule described in figures 1 and 2 can be used.

Figure 1: Today's simplified process of assigning customs tariff numbers and other customs codes

For the classification of other goods, however, further information is necessary, such as:

- Blood samples → human or animal blood? Can the article number and the name of the exporter be used to find the answer? Dangerous, infectious, harmful, or toxic blood samples?

- Chemicals → Name and composition of the chemical? CAS number? Dangerous, infectious, harmful, or toxic chemicals? Intended use?

- Screws → Specification such as size and material, standard, part number available? Value of goods?

- Seals → Material of seals, intended use? Name exporter/importer? Value of goods? Catfishing set → Picture, intended purpose, material?

Depending on the goods, it is therefore different, which additional information must be given so that a customs tariff number can be assigned. If there is not enough information on the customs documents (in this case invoices), e.g., article numbers, are searched for on the importer/exporter websites to find complete descriptions of the goods or the name of the chemical to find a CAS number. Finding the CAS number makes it ultimately possible to search the internet for a binding customs tariff number. If insufficient data is available on the Internet, the importer/exporter is contacted for more information. The shipment may have to be stopped/stored for clarification (currently approx. 6.5 days retention time of a stored shipment due to a general lack of information for customs clearance).

Other data on the invoice can help determine the customs tariff number for goods such as screws and gaskets. For example, the screw could still contain the addition "Din 933", under which the size of the screws and their material is known. Gaskets could cost, e.g., 150,- € per piece and have been sold by dealer Steel Seal Inc., whereby an experienced customs specialist no longer has to search the internet for the article number or the goods and can assign the customs tariff number directly. It is known that rubber or plastic seals from China never cost below 10,- € per piece. The material characteristic within the company name gives further information about the good's property.

Figure 2: Determination of combined nomenclature / TARIC (extensive thumb rule)

![604e890c1981242e1f1a2448_20201123 scheme tarifing [Automatisch gespeichert]-page-002.jpg](https://strapi.api.digicust.com/uploads/604e890c1981242e1f1a2448_20201123_scheme_tarifing_Automatisch_gespeichert_page_002_ef66744f8e.jpg)

Once a suitable customs tariff number has finally been identified, general and specific notes and explanations of the relevant sections, chapters, and items for the classification of goods must be checked in a customs tariff book or, e.g., the electronic customs tariff information (EZT-Online.de). For example, the good catfishing rod could have been listed as a toy, where some customs declarants would analyze chapter 95, position 03. If the notes and explanations are not read there, the customs declarant may make the mistake of classifying according to toys. However, the regulations clearly state that animal toys may not be classified in Chapter 95 for toys, but must be classified according to their nature, i.e., the material. In this case, the customs specialist would have to know whether the material was produced from several materials, whether this material gives the product a specific function and if no function is present, whether the material proportions are evenly distributed or whether one material makes up the majority of the goods. As soon as nature's questions have been clarified, the customs tariff number can be identified, whereby a renewed examination of the remarks and explanations is necessary to exclude eventualities. An excellent example of this is, e.g., ex-/inclusion criteria for goods classification or court decisions, where goods and their classification are explicitly mentioned, etc.).

Now that customs tariff numbers have been identified, they can be noted on the sheet of paper next to the goods in question for documentation purposes (necessary, for example, to find out who made mistakes or in case of appeals). Additional information, such as the goods are not toxic, dangerous, infectious or harmful, or preferential certificates on invoices, proofs of origin, etc., must be classified according to particular document type and preference type codes. These customs codes are written down on the invoice or document as well (in addition to error identification, necessary, for example, for a data entry person to know how to fill out the customs declaration). Once all customs codes have been assigned, the data is entered into the customs software and finally sent to the customs office in the form of an electronic customs declaration.

These processes' complexity and duration become particularly apparent when a customs case has between 50 and 200 goods items, and a customs service provider serves hundreds of different exporters/importers of goods. In such cases, the customs clearance process's duration ranges from about 30 to 100 minutes on average. However, the complexity can increase if customs procedures such as bonded warehouse procedures, re-imports or re-exports, etc., have to be handled. Still, such cases are relatively rare (depending on the forwarder's business focus). The high complexity of customs clearance, particularly product classification, requires a lot of time and leads to many errors and administrative penalties, which means an increased effort for customs offices, forwarding agents, and exporters and importers. Only about 75% of all product classifications are correct, which means that there is a lot of room for improvement. Moreover, only when the correct customs tariff number has been chosen, the right measures, prohibitions, and restrictions, special units of measurement can be derived as described at the beginning of this article.

In conclusion, customs code classification can be considered as one of the most important tasks in customs procedures. In this matter, it is essential to find ways of how to optimize this process in terms of speed, complexity and quality, so that administrative penalties and time-consuming tasks are avoided and a better customs clearance service to customers is delivered.

News from our Blog

Learn about customs clearance, foreign trade, our product updates and our latest achievements.