Latest Insights on Customs & AI

Stay updated with the latest trends, best practices, and innovations in customs automation and international trade.

Optimisation of customs processes at ZLS

How ZLS Logistik Service achieved a 90% reduction in processing time and 70% cost reduction through Digicust's AI-powered automation solution.

Digitization of customs processes at Wackler Spedition & Logistik

How a 175-year-old family business achieved 64% processing time reduction and automated 16,000 customs declarations in just 3 months.

Zollsoftware und Vor-Zollsoftware

Im Kern bieten wir Vor-Zollsoftware an, die den manuellen Prozess der Zollabwicklung minimiert. Unsere Software arbeitet mit allen gängigen Zollsoftwaresystemen zusammen, wie z.B. LDV Zollsoftware, dbh Zollsoftware und vielen anderen Anbietern. Wenn Digicust mit einer Zollsoftware verwendet wird, übernimmt es die manuelle Arbeit, indem es die Zolldokumente liest, klassifiziert und eine fertige Zollanmeldung erstellt. Wie ein zusätzlicher Mitarbeiter in Ihrer Zollabwicklung. ## Wie trägt KI zur Automatisierung in der Zollabwicklung bei? KI ermöglicht eine Hyperautomatisierung in der Zollabwicklung. Das bedeutet: * Intelligente Dokumentenverarbeitung: Automatisches Ausfüllen von Zollanmeldungen aus verschiedenen Dokumenten wie Rechnungen und Packlisten. * KI-gestützte Zolltarifierung: Automatische Ermittlung von Zolltarifnummern, anderen Zollcodes und weiteren relevanten Daten für die Zollanmeldung * No-Code Automatisierung: Benutzerfreundliche Tools zur Automatisierung spezifischer Zollprozesse ohne Programmierkenntnisse. * Integration in führende Zollsoftwareanbieter: Nahtlose Zusammenarbeit mit Anbietern wie AEB, Dakosy, dbh, LDV und BEO. * Unterstützung verschiedener Zollverfahren: Abwicklung von Einfuhr, Ausfuhr, Intrastat und weiteren Verfahren. ## Inwiefern kann die Verwendung von KI-gestützten Zollassistenten die Effizienz des Zollprozesses verbessern? Die Verwendung von KI-gestützten Zollassistenten bietet zahlreiche Vorteile: * Automatisierung sich wiederholender Aufgaben: Reduzierung manueller Arbeit und menschlicher Fehler. * Nahtlose Integration in bestehende Zollsoftware-Systeme * Verbesserte Genauigkeit: Präzise Analyse von Daten führt zu korrekten Zollcodes und und -tarifnummern. * Optimierte Prozesse: Zusammenführung von Daten aus verschiedenen Quellen zur Identifizierung effektiver Abläufe. * Steigende Effizienz: Zeit- und Kostenersparnis durch automatisierte Zollanmeldungen. * Skalierbarkeit: Anpassung an wachsendes Geschäftsvolumen ohne Einbußen bei Genauigkeit oder Effizienz. Bei Digicust sind wir bestrebt, kontinuierlich an der Weiterentwicklung unserer KI-Technologien zu arbeiten, um unseren Kunden die bestmöglichen Lösungen für ihre Zollabwicklung zu bieten. Kontaktieren Sie uns noch heute, um mehr über unsere Produkte und Dienstleistungen zu erfahren und wie Digicust Ihr Unternehmen unterstützen kann. ## Erweiterung und Fortschritt Als führender Anbieter von Zoll-Lösungen auf Basis künstlicher Intelligenz (KI) ist Digicust stets bestrebt, die Zollabwicklung für Unternehmen weltweit zu revolutionieren. In diesem Beitrag wollen wir einen ausführlichen Blick darauf werfen, wie unsere fortschrittlichen KI-Technologien die Zukunft der Zollsoftware gestalten. ## Die Evolution der Zollabwicklung: Von manuell zu automatisiert Traditionell war die Zollabwicklung ein zeitaufwändiger und fehleranfälliger Prozess, der eine Menge manueller Arbeit erforderte. Doch mit dem Einzug von KI-gestützten Zollassistenten kannsich diese Situation grundlegend ändern.. Durch intelligente Dokumentenverarbeitung und automatische Zolltarifierung werden Prozesse beschleunigt ,Fehler minimiert und Kosten gespart. ## Ein kurz- bis mittelfristiger Ausblick in die Zukunft Bei Digicust stehen wir erst am Anfang unserer Reise. Wir werden weiterhin in die Entwicklung und Verbesserung unserer KI-Technologien investieren, um die Zollabwicklung für Unternehmen noch einfacher, schneller und kosteneffizienter zu gestalten. Insbesondere in den Bereichen: * automatisches Ausfüllen von Zollanmeldungen auf Basis unterschiedlicher Datenquellen (ERP-, TMS-Systeme, eine Vielzahl unterschiedlicher Dokumententypen im PDF, JPG, XLSX-Format, Kopiervorlagen, Stammdaten, Zoll-Software-Daten sowie Feedback-Daten von Zolldeklaranten), * maschinell generierte, erklärbare sowie verbindliche Zolltarifauskünfte** (VZTA), * Überprüfungen von bestehenden Zolltarifnummern,** * Compliance Checks, Sanktionslistenprüfungen, Lieferantenerklärungen,** * Optimierung von falschen Daten respektive der Datenqualität,** * Betrugserkennung, Dokumentenkontrolle sowie automatische Anforderung von qualitativen, strukturierten Daten zur Hebung des Automatisierungsgrades. ## Kontaktieren Sie uns noch heute Wenn Sie mehr darüber erfahren möchten, wie Digicust Ihr Unternehmen bei der Optimierung der Zollabwicklung unterstützen kann, zögern Sie nicht, uns zu kontaktieren. Unser erfahrenes Team steht Ihnen jederzeit zur Verfügung, um Ihre Fragen zu beantworten und maßgeschneiderte Lösungen für Ihre individuellen Anforderungen zu entwickeln.

The Complete Guide to HS Code Classification in 2026

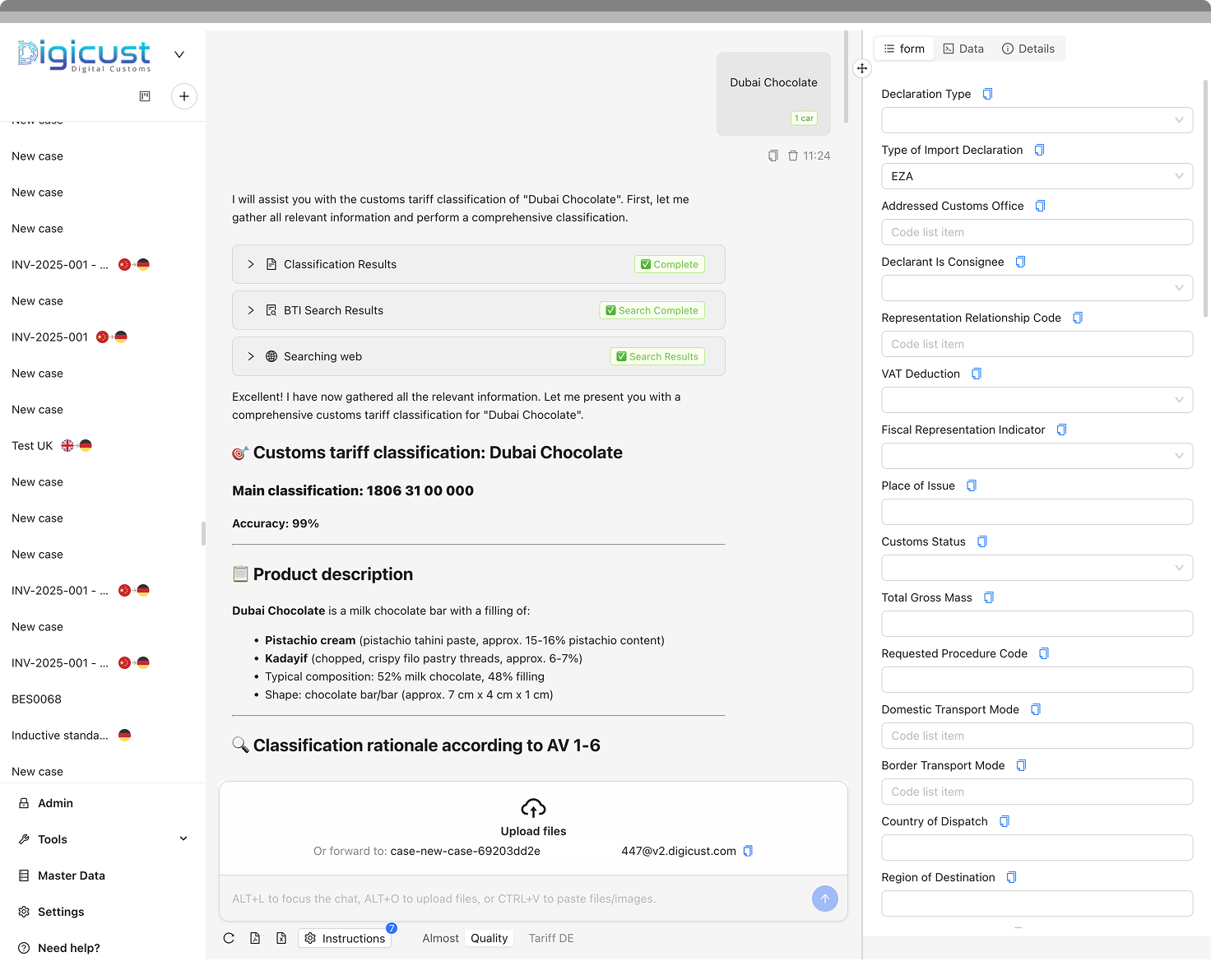

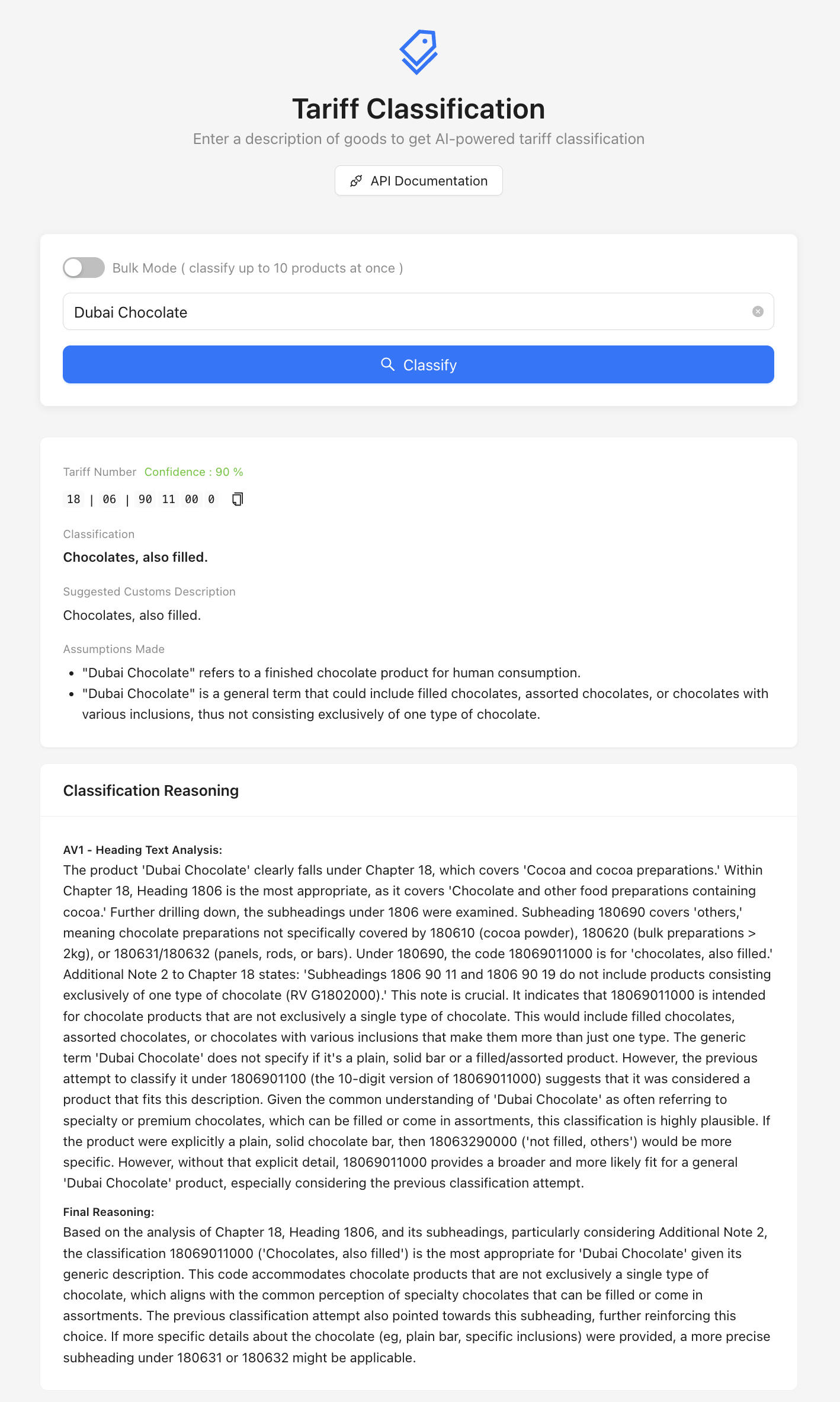

When people think about international trade, they often imagine containers, customs officers, and endless paperwork. What they rarely see is the hidden backbone of global commerce: HS code classification. In 2026 this task has become even more important. Customs authorities around the world are tightening rules, increasing audits, and enforcing stricter penalties for incorrect declarations. At the same time, supply chains have accelerated — leaving less time for manual checks and second guesses. The good news? With the right understanding, and today even with the help of AI tools, classification doesn't need to be intimidating or unpredictable. This guide walks you through everything from the basics to advanced techniques, including a real example that illustrates how classification works in practice. ## What Is an HS Code? An HS Code (Harmonised System Code) is a global 6-digit product classification used by customs authorities to determine: * Import duties * VAT and excise * Export control requirements * Trade statistics * Country of origin treatment * Risk profiles for customs clearance More than 200 countries and economies use the HS as the basis for their tariff systems — making it one of the most influential regulatory standards in the world. ## HS Codes, Harmonised Codes & Tariff Codes — What's the Difference? People often use these terms interchangeably, and it causes confusion. Here's how they actually relate: **HS Code** — Global 6-digit standard by the WCO **Harmonised Code** — Same as HS code **Tariff Code** — Country-specific extension beyond 6 digits **Commodity Code** — EU/UK name for tariff codes **CN Code** — EU 8-digit "Combined Nomenclature" **TARIC Code** — EU 10-digit tariff code **HTS Code** — U.S. 10-digit Harmonized Tariff Schedule Most countries take the global HS and extend it further. **Example for filled chocolate bars:** * HS (6-digit) → 180631 * EU CN (8-digit) → 18063100 * EU TARIC (10-digit) → 1806310000 National systems may even add statistical digits beyond that. ## How the Global HS System Works The HS system has four main layers: * 21 Sections * 97 Chapters * Over 1,200 headings * More than 5,000 subheadings A typical structure looks like this: * 18 → Chapter (Cocoa) * 1806 → Heading (Chocolate & cocoa preparations) * 180631 → Subheading (Chocolate, filled) Countries then extend the code depending on their tariff system. ## The Six General Rules of Interpretation (GRI) The GRI rules are the legal foundation for HS classification. Every classifier — whether a customs officer or AI system — must apply them in order. Here's the human-friendly version: ### GRI 1 — Start With the Obvious Stuff You must begin with: * Section Notes * Chapter Notes * Heading descriptions If the wording clearly fits the product, the job is almost done. ### GRI 2 — Don't Be Fooled by Incomplete or Mixed Items Covers: * Items that aren't fully assembled yet * Items missing minor components * Mixed materials If something still has its essential character, it stays in the same area of the tariff. ### GRI 3 — When More Than One Heading Seems Possible This rule feels like real-world decision-making: * The more specific description wins. * If that doesn't settle it → essential character. * If still tied → choose the heading that appears later in numerical order. ### GRI 4 — The "Closest Match" Rule If nothing fits perfectly, classify the item as something most similar. Used rarely, but it exists for edge cases. ### GRI 5 — Packaging Rules Some packaging is classified with the product (like camera cases), others aren't. ### GRI 6 — Apply All Rules Again at Subheading Level Everything you did at heading level must be repeated when choosing between subheadings. ## Case Study: Classifying "Dubai Chocolate" This example makes classification more tangible and comes from a real AI demonstration. Below, you can see the Digicust Digital Customs platform in action, classifying "Dubai Chocolate" using our AI assistant:  *The Digicust Digital Customs platform showing AI-powered classification of "Dubai Chocolate" with 99% accuracy. The interface includes an AI chat assistant, classification results, BTI search results, and a comprehensive customs declaration form.* The product contains: * Milk chocolate coating * Pistachio cream * Kataifi pastry strands * Tahini (sesame paste) At first glance, it could fall into several categories. ### Step 1 — Identify Candidate Headings **Heading 1806** — Chocolate & cocoa preparations (might apply) **Heading 1905** — Bakery products (due to kataifi pastry) **Heading 1704** — Sugar confectionery (only if no cocoa) Because the product contains cocoa, 1704 is ruled out at GRI 1. ### Step 2 — Use GRI 3 (Essential Character) Even though it contains pastry strands, the chocolate coating defines: * the product's taste * its appearance * how it is sold * how it is understood by consumers So under GRI 3(b), chocolate wins over pastry. ### Step 3 — Choose the Correct Subheading Under heading 1806: * The product is filled * It's presented as chocolate confectionery * It meets the format requirements (bars/slabs or similar products) So the correct HS subheading is: **1806.31 — Chocolate, filled** ### Step 4 — Country-specific extensions * EU CN code: 18063100 * Many national systems: 1806310000 * Additional statistical digits may apply depending on country ### External confirmation Independent tariff databases confirm: * 1806.31 = filled chocolate products * EU CN (8-digit) 18063100 matches filled chocolate * World Bank WITS trade flows for 180631 correspond to filled chocolates So the logic and the final classification align well with global HS standards. ## The 7 Most Common HS Classification Mistakes From real customs practice, these are the mistakes that cause the most audits, delays, and retroactive duties: 1. **Ignoring Chapter and Section Notes** — These are legally binding and must be checked first. 2. **Choosing a code because it "looks right"** — Classification requires systematic analysis, not intuition. 3. **Copying a supplier's classification without checking** — Suppliers can be wrong, and you're legally responsible. 4. **Using marketing names instead of technical descriptions** — Customs uses technical terminology, not brand names. 5. **Misunderstanding "essential character"** — This is a key concept in GRI 3 that requires careful analysis. 6. **Assuming similar products share the same HS code** — Small differences in composition or form can change classification. 7. **Failing to update classifications when a product changes** — Any change in materials, form, or function may require reclassification. ## How AI Is Transforming HS Classification in 2026 Until recently, tariff classification relied entirely on: * personal expertise * internal notes * trial and error * time-consuming research But in 2026, AI systems can: * read product descriptions * analyze images * extract technical data * search BTI databases * apply GRI rules step by step * draft human-readable justifications This doesn't replace experts — it augments them. AI handles the heavy lifting, and humans make the final call for borderline cases. ## AI Tariff Classification at a Glance Modern AI classification systems (like Digicust's Taric Classifier) typically offer:  *The Digicust Tariff Classification web tool provides instant AI-powered classification with detailed reasoning. Simply enter a product description to receive accurate HS code classification with confidence scores and GRI-based explanations.* * High accuracy based on large training corpora * Automatic BTI case matching * Image-based classification support * GRI-reasoning explanations * Country-specific tariff extension support * Bulk processing for catalogs * Confidence scoring * Audit trails showing how each decision was made * Integration with customs software and ERPs The key benefit in daily operations is consistency. AI doesn't get tired, doesn't skip steps, and doesn't rush through classifications — which makes it a valuable partner for customs teams. ## Best Practices for Accurate HS Classification 1. **Start with official notes, not guesses** — Always check Section and Chapter Notes first. 2. **Apply GRI rules in the correct order** — GRI 1 through 6 must be applied sequentially. 3. **Use technical data, not marketing language** — Focus on composition, function, and form. 4. **Check BTI decisions for guidance** — While not binding for your product, they show how customs interprets similar items. 5. **Document your reasoning every time** — This creates an audit trail and helps with future classifications. 6. **Revisit classifications when materials change** — Even minor changes can affect the code. 7. **Consider using AI for bulk or repetitive tasks** — AI excels at consistent, high-volume classification work. ## FAQ ### Is the HS code the same in every country? Only the first 6 digits are globally harmonised. Everything beyond that differs by country. ### Can a product have more than one HS code? No. It must have one correct code, even if multiple ones seem possible at first. ### Is classification a legal obligation? Yes. Incorrect classification can lead to retroactive duties, penalties, or shipment stops. ### Are BTI rulings binding? Only for the company that requested them, but they are helpful for understanding how customs may interpret similar products. ### Can AI replace human classifiers? AI can automate the heavy research work, but humans remain essential for edge cases and compliance interpretation. ## Final Thoughts HS classification is sometimes seen as bureaucratic, but at its core it's a form of problem-solving. You take a product, understand what it truly is, follow a globally agreed set of rules, and arrive at a legally sound result. In 2026, with more complex supply chains and tighter regulations, combining human expertise with the speed and consistency of AI creates a more reliable, less stressful classification process. It helps teams focus on the parts of customs work that require judgment and experience — while giving routine classification a level of structure and transparency that simply wasn't possible before.

Postdienste stoppen Paketversand in die USA: Komplexität beherrschbar machen – mit KI als Schlüssel

Wien (OTS) — Weltweit haben zahlreiche Postdienste den Paketversand in die USA vorübergehend eingestellt. Dies macht deutlich, wie sensibel internationale Ströme reagieren, wenn sich die Rahmenbedingungen plötzlich ändern und viele Zollverfahren noch manuell und uneinheitlich durchgeführt werden. Viele hatten sich an Schwellen wie die De-minimis-Freigrenze gewöhnt, doch solche Erleichterungen sind keine Konstante. Regeln können sich abrupt ändern. Für Unternehmen bedeutet das: Schocks sind unvermeidbar, aber abzufedern. Künstliche Intelligenz ist zwar kein Wundermittel, aber ein wirksamer Hebel. Sie ordnet verstreute Informationen, erkennt fehlende oder unplausible Angaben, macht nachvollziehbare Vorschläge und dokumentiert Entscheidungen lückenlos. So sinkt der Anteil der Fälle, die eine manuelle Klärung erfordern, während die Abfertigung verlässlicher wird – selbst dann, wenn Vorschriften dynamisch bleiben. Digicust automatisiert Zollprozesse mit vertrauenswürdiger KI, reduziert den manuellen Aufwand und sorgt für Konformität. Die Lösungen decken den gesamten Prozess ab: von der Wareneinreihung und Zollanmeldung über Prüfungen bis hin zu Analysen und der Integration in bestehende Systeme. Das Ziel besteht darin, einen Betrieb zu ermöglichen, der bei Änderungen innerhalb von Stunden nachsteuert und nicht erst nach Wochen. Der aktuelle Stopp macht deutlich, wie eng Datenqualität, klare Verfahren und Anpassungsfähigkeit miteinander verbunden sind. Mit einer belastbaren Datenbasis und sinnvoll eingesetzter KI lassen sich künftige Unterbrechungen eher vermeiden.

Digicust to Expand AI Agents for Customs to Belgium and the Netherlands

Digicust, an Austrian deep tech startup and pioneer in AI agents for customs automation, has announced plans to launch its innovative AI agents for customs clearance in Belgium and the Netherlands by the end of 2025. This strategic initiative is being carried out in parallel with an in-depth market study to gain a thorough understanding of market dynamics and customer requirements in Belgium. ## Strategic Expansion Supported by aws Program Support for the expansion comes from the Austria Wirtschaftsservice (aws) "aws Technologie-Internationalisierung Programm" which highlights the strategic importance and innovative potential of this initiative. After a highly successful market entry in Germany last year, Digicust is now positioning itself strategically to become the leading provider of AI agents for customs clearance solutions. ## Leadership Vision for European Market Dominance "Expanding into Belgium and the Netherlands is the logical next step in our growth journey," said **Borisav Parmakovic, CEO of Digicust**. "These markets are strategically vital due to their role as major European gateways for international trade. Our advanced AI customs agents streamline processes, significantly reduce errors, and provide substantial cost savings, positioning our clients at the forefront of customs digitization." ## Comprehensive Market Analysis Strategy The concurrent market study is led by **Bernhard Klug**, who emphasized: "Our comprehensive analysis is not just about understanding market conditions; it's about actively engaging with potential customers and partners from day one." ## Advanced AI Technology Capabilities Digicust's AI agents automate complex customs processes including: ### Core Automation Features - **Complex customs documentation** - Automated generation and validation - **Tariff classification** - AI-powered HS code determination - **Compliance checks** - Real-time regulatory validation - **Fraud detection** - Advanced pattern recognition and risk assessment ### Operational Benefits - **24/7 customs clearance** - Continuous processing capabilities - **Drastically reduced manual workloads** - Up to 30% efficiency improvements - **Increased operational efficiency** - Streamlined workflow automation - **Enhanced security** - Advanced threat detection and prevention - **Improved supply chain speed** - Faster processing and clearance times ## Seamless Integration Advantage This cutting-edge technology integrates seamlessly into existing software solutions, offering rapid adoption and immediate benefits for businesses of all sizes. ## Strategic Market Positioning Belgium and the Netherlands represent critical European trade hubs, making them ideal markets for Digicust's expansion strategy. The countries serve as major gateways for international commerce, with significant volumes of customs declarations and complex trade requirements that can benefit from AI automation. ## Future Outlook This expansion represents a significant milestone in Digicust's journey to become the leading AI customs automation provider across Europe. The success in Germany has provided valuable insights and proven market demand for intelligent customs solutions. ## About Digicust FlexCo Founded in 2020 and headquartered at Vienna Airport, Digicust is revolutionizing customs clearance through AI-powered solutions, enabling businesses to automate, simplify, and accelerate customs processes with unmatched accuracy and efficiency. --- **Press Contact:** Bernhard Klug, MSc – Head of Marketing Email: marketing@digicust.com Website: www.digicust.com

Showing 6 of 41 articles